Blockstream AMP Case Studies¶

Case Study 1: Bermudian Stimulus Token Pilot¶

The Problem¶

The Bermudian government wants to provide financial stimulus to those citizens affected by COVID-19 and ensure that citizens spend that stimulus within the local economy. However, traditional solutions had severe drawbacks.

The physical distribution of debit cards is slow and expensive.

Stimulus funds cannot be targeted toward local businesses to benefit the local economy with direct payments or debit cards.

The Solution¶

Using Blockstream AMP, Stablehouse worked with the Bermudian government to develop a testing program to demonstrate the feasibility of a digital token-based stimulus program.

Testers downloaded Blockstream Green to their smartphone and registered a wallet with Stablehouse. Stablehouse enabled a digital test token that was distributed to the testers. The token was only transferable to a limited amount of other testers, ensuring that the stimulus remained within the local economy and a whitelisted group of users.

Stablehouse worked with a test group of merchants to provide a point-of-sale solution to accept payment of these tokens. Stablehouse provided each merchant with an inexpensive device capable of generating an invoice for their customer for each transaction. Customers used their smartphones to scan the QR code and complete their payment with the token. The system could be designed so that the government could reimburse each merchant for the tokens received.

Benefits¶

Accessible to anyone with an Android or iOS device.

Easy setup for merchants.

Recurring payments can be made at a low cost.

Ability to ensure benefits remain within the local economy.

How it Works¶

Selecting an Asset Type¶

Two types of assets can be issued in Blockstream AMP: transfer restricted assets and issuer tracked assets. Stablehouse—as the pilot issuer in this case—used transfer restricted assets to ensure that citizens could only spend the stimulus tokens at approved merchants.

Issuing the Asset¶

Using Blockstream AMP, Stablehouse first created and registered the tokens using Blockstream AMP. The tokens were then sent to Stablehouse’s treasury wallet. The treasury wallet can issue more of the token (“reissuance”) when required.

At issuance, Stablehouse chose a ticker, name, icon, and associated domain. Stimulus recipients can use this data to verify that the tokens they receive are genuine.

Configuring the Transfer Rules¶

Out of the box, Blockstream AMP supports restrictions based on categories (each user can be assigned one or more categories when they register their account). However, in this instance, a more sophisticated scheme was required to ensure transactions could only occur in one direction—from testers to merchants.

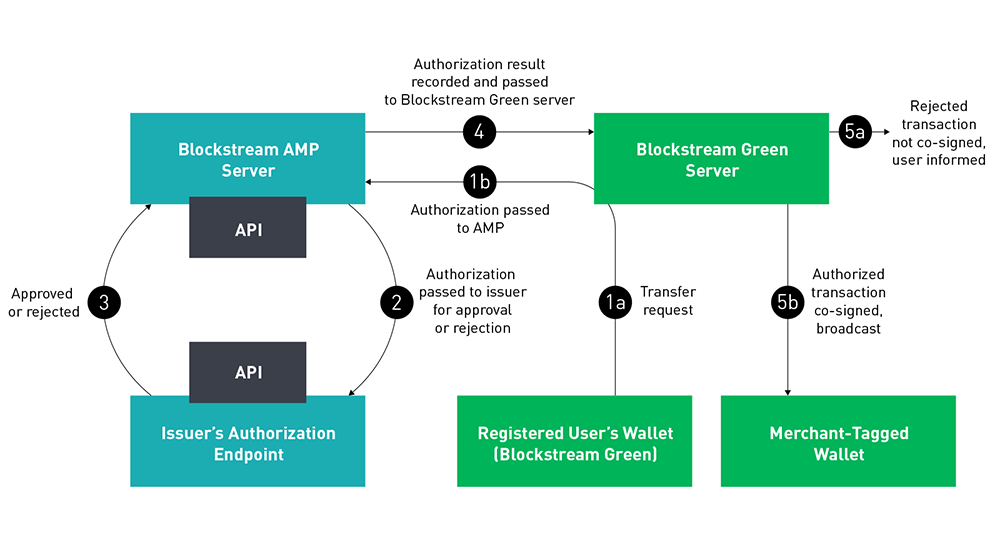

To accomplish this, Stablehouse used the authorization override feature of Blockstream AMP to approve or deny transfers based on their own system’s logic. If the intended recipient of the transfer was one of the approved merchants, it was allowed; otherwise, it was denied.

Transfer restricted asset approval process (using issuer API override)¶

Building the Point-of-Sale¶

The technology provider built the point-of-sale (POS) on the low-cost, open-source M5 stack device. Each merchant’s POS connects to a remote server that generates the invoice and notifies the device when a transaction is complete.

The technology provider implemented the server using BTCPay Server, which supports Liquid assets. Whenever BTCPay Server generates an invoice, the merchant requesting the invoice is tagged on the transaction so that reconciliation can occur.

Each address that is generated by the BTCPay Server invoice is automatically whitelisted and used to approve transactions through the Blockstream AMP callback function. Blockstream AMP uses this whitelist to approve transactions through the callback function.

Distributing the Stimulus Token¶

Stablehouse distributed the stimulus token to each of the registered users in the system. A small amount of L-BTC was also sent to each user to ensure they can cover network fees (currently 0.1 sats / vbyte). Future versions of the program could include customized wallets built on top of the Green Development Kit (GDK) that allow for a completely customized experience.

Case Study 2: Exordium Security Token¶

The Problem¶

Exordium, the publisher of massively-multiplayer space strategy game Infinite Fleet (developed by Pixelmatic), is issuing a digital equity token. However, popular token issuance solutions posed several challenges:

Issuers must implement the transfer restrictions required by security tokens at the smart-contract level, making it very difficult to adapt to fast-moving regulations worldwide.

Platforms such as Ethereum are showing the strain of adoption, with unreliable transaction times and excessive transaction fees.

A lack of on-chain privacy leads to investors revealing sensitive information about their financial activities.

The Solution¶

Exordium is working with technology and compliance provider STOKR to issue a digital equity or security token known as EXO on the Liquid Network, using Blockstream AMP (subject to regulatory approval). The token will provide a profit share to investors from the game’s profits. The EXO token is also compatible to receive an ISIN code. ISIN codes are beneficial for institutional investors to track investment holdings consistently across markets worldwide.

Using Blockstream Green, each investor can register their Managed Asset Account with STOKR or other issuance partners. By registering, an investor is added to a list of approved investors, enabling them to receive and send the EXO token.

Blockstream AMP implements transfer restrictions through a simple multisig authorizer setup, providing Exordium with flexibility to adapt to shifting regulations. Liquid’s cutting-edge privacy technology, Confidential Transactions, secures users’ sensitive financial data. The Liquid Network also currently offers much lower transaction fees than other issuance platforms and supports the Lightning Network for further scale if needed.

Benefits¶

Transfer restrictions implemented at the protocol level using multisig.

Adaptable to shifting regulations through Blockstream AMP’s authorizer API.

Secures the financial privacy of investors.

Immediate wallet support with Blockstream Green.

How it Works¶

Selecting an Asset Type¶

Two types of assets can be created in Blockstream AMP: transfer restricted assets and issuer tracked assets. Exordium used transfer restricted assets to ensure that only approved investors could send and receive the EXO token.

Issuing the Asset¶

Exordium, together with STOKR, will issue the EXO token using Blockstream AMP. The newly-issued EXO token will then be sent to Exordium’s treasury wallet in preparation for distribution to registered investors.

Exordium will hold reissuance keys so that they can authorize additional tokens according to their allocations (e.g., future equity sale). The issuance will not be confidential, which means that anyone can verify the total supply at any time.

At issuance, Exordium will choose a ticker, name, icon, and associated domain. Investors can use this data to verify that Exordium genuinely issued the asset they receive.

Configuring the Transfer Rules¶

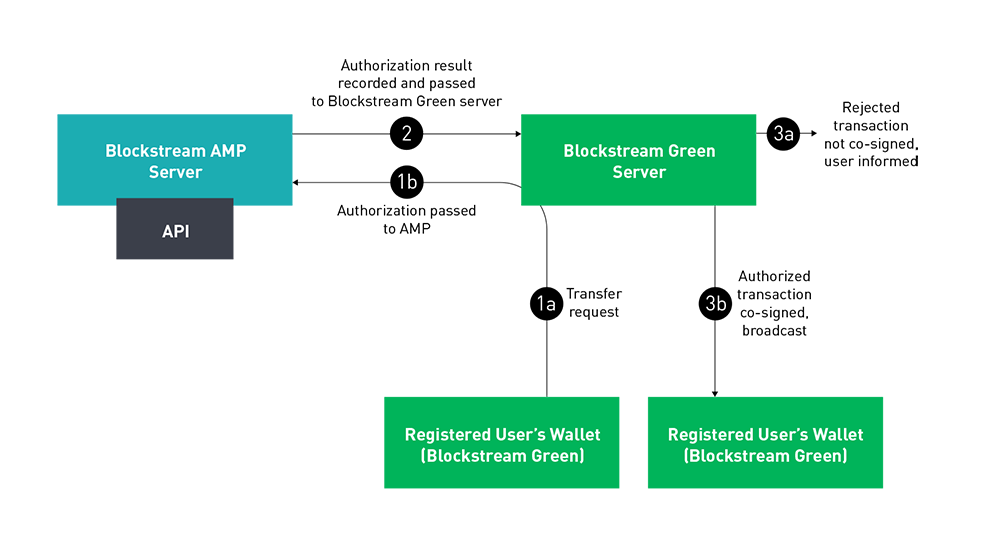

Exordium will implement EXO transfer restrictions using Blockstream AMP’s in-built category-based controls. STOKR will assign each registered investor to a unique category: approved KYC/AML status.

Only investors that satisfy this category can receive or send the EXO token. The multisig authorizer will deny any transactions sent to users that do not satisfy the correct category requirements by refusing to sign the second multisig key.

The authorizer is implemented through Blockstream Green.

Transfer restricted asset approval process (using categories)¶

Distributing the Security Token¶

STOKR will calculate the relevant token amount to be received by each investor that has purchased simple agreements or future tokens (SAFTs), then supply this data to Exordium. Exordium will then distribute the EXO token to the investors from their treasury wallet. A small amount of L-BTC will also be sent to each investor to ensure they can cover Liquid Network transaction fees.

Case Study 3: Blockstream Mining Note (BMN)¶

The Problem¶

Blockstream wanted to tokenize an offering that allowed people to get exposure to the revenue opportunities of Bitcoin mining without the need to operate mining equipment themselves.

The structure of the regulations surrounding the offering meant that investors who bought and traded the asset had to be eligible to do so. The issuer needed to make sure that the asset was therefore only ever held by approved investors and that they could provide ownership details at any point in time. It was important to the issuer that the investors be able to take custody of the asset and trade it among themselves while the issuer retained the ability to reimburse any investors who lost access to their digital wallets.

The Solution¶

The issuer chose to tokenize the offering by issuing it as a transfer restricted AMP asset on the Liquid Network because it allows owners to trade with other peers and take custody of the asset themselves. From the issuer’s perspective, AMP provides them with the assurance that all trades are between registered investors and makes a range of reporting and audit data available, while still providing their investors with on chain privacy thanks to Liquid’s confidential transactions.

Benefits¶

Why issue the asset using AMP?

Investors can custody the asset themselves in the Blockstream Green wallet.

Confidential transactions on the Liquid network allow anyone transacting an asset greater privacy and protection from front-running.

As long as both parties are approved investors, transfer restricted AMP assets can be traded on exchanges, peer to peer, or by using a swap platform such as SideSwap.

The management of the asset, including reports and audit data, is available to the issuer through AMP, should the issuer be asked to satisfy the requirements of an external auditor. Ownership can be cryptographically proved on the Liquid blockchain by an investor if they need to do similar.

Investor KYC registration and initial sales recording can be delegated to an external service provider by the issuer using AMP, should they not want to carry out this process themselves.

How it Works¶

Selecting an Asset Type¶

The asset was issued as a transfer restricted AMP asset so that regulations surrounding investor registration could be met. AMP’s ability to reject a transaction means that the asset cannot be transferred to investors that are not registered as an approved recipient.

Configuring the Transfer Rules¶

Asset issuers are able to screen and then approve investors as eligible to receive the asset. Additional, more fine-grained, rules can be applied by an API run by the issuer. These endpoints allow entities such as exchanges or swap markets to check that withdrawals and transfers meet the regulatory requirements outlined in the original term sheet.

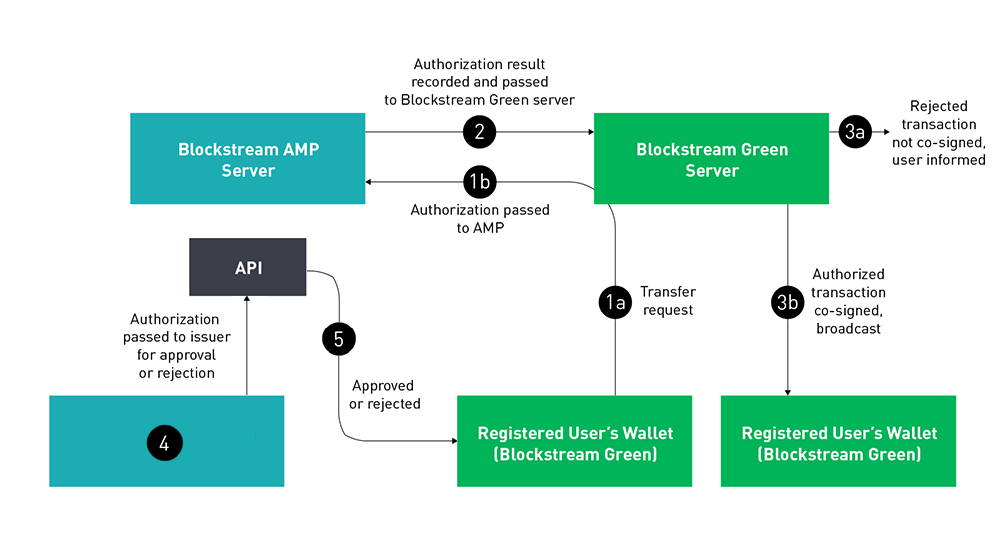

Transfer Restricted asset approval process (using additional authorization API)¶

In the above diagram the process flow for a peer to peer trade would be [1a] to [3b]. In cases where the investor has previously transferred BMN to an exchange [4] it may be (depending on the rules applicable) that the exchange calls out to an additional API that the asset issuer has made available. This additional API has access to the data held within AMP and so can be configured to apply any number of rules relating to:

Sending exchange.

Receiving investor.

Existing investor balance.

Withdraw request amount.

Enabling Peer to Peer Trading¶

External platforms (such as SideSwap) have created swap markets that allow AMP assets to be traded between peers. A ‘swap’ is a single transaction that finalizes a trustless exchange of assets between two or more parties. It is much safer than having to trust the other person to complete their part of a traditional two-step exchange after you have completed yours. AMP assets can also be traded between investors through their own arrangements. The issuer can be confident that although they are not involved in trades, they will always be between investors meeting their regulatory requirements.

Distributing Rewards to Asset Holders¶

On completion of the term of the contract the issuer can use the AMP reporting API to obtain balances for each investor at the time of expiry. The issuer can then use the data to determine the amount of rewards to pay each investor. If the rewards are payable over the Liquid network, AMP is able to provide the issuer with new addresses for each investor due the payment.